Digital innovation across our financial industry is evolving at the pace of Moore’s law on steroids — reshaping the structure of our markets, transitioning buying power to the consumer, and dislocating segments of the customer value chain once dominated by traditional banks.

Fintechs have been busy pushing legacy banks toward product innovation of payments, settlements/clearing, online loans, and more, rewriting the standards for customer experience and highlighting the volume of waste and inefficiency associated with the fixed cost structure of traditional banks.

Despite the challenges faced by fintechs last year, the reality is the pace of innovation in financial services shows no signs of deceleration. This is especially true for the United States. Digital transformation of the industry will only increase, and the U.S. is very clearly working to catch up with the progress seen in the rest of the world.

At last, we now possess the capability for contactless and peer-to-peer payments, a feature that has been accessible in other regions for many years. Now the U.S. Federal Reserve launched FedNow, a new instant payment infrastructure, joining nations like Mexico, India, Brazil, Singapore, and the EU, in fostering momentum toward facilitating immediate payments and transactions.

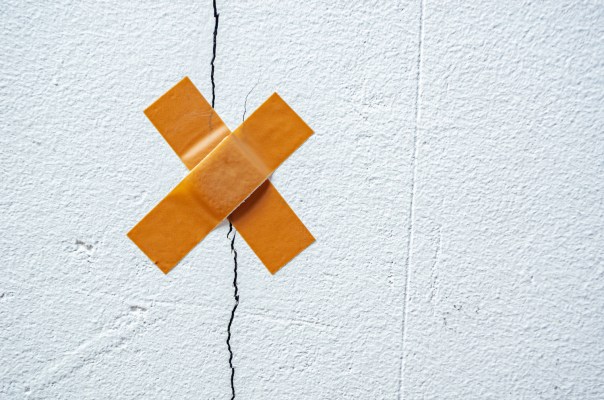

Yet, with greater innovation does indeed come greater responsibility. While banks strive to maintain innovation for catering to customer demands and enhancing their competitive advantage, they will discover that achieving this becomes challenging unless they adapt their approach to assessing and integrating new technological solutions.

Digital transformation of the industry will only increase, and the U.S. is very clearly working to catch up with the progress seen in the rest of the world.

This adaptation is crucial to address the ever-evolving compliance requirements. Instances of increasing fraud cases and the potential for heightened financial crime risks have already been noted in relation to new initiatives like FedNow.

Therefore, the best technologies will be those created through the lens of regulatory limitations — a compliance by design approach — utilizing these regulations as the foundation for future digital solutions. It’s only in this way that banks can ensure they come out on top in the financial services industry’s race toward complete digital transformation, and do it well.

The shifting regulatory perimeter

Let’s first discuss why such a shift in mindset for fintech innovation is needed. Currently, Tradeshift and HSBC are working to revolutionize the world of working capital management. Citi and IntraFi are helping their clients to unlock trapped cash, and Amazon and JPMorgan are redefining the payment ecosystem.

Fintech companies stand out by tapping into unregulated parts of finance, owning fewer assets, and working flexibly on a larger scale. This is quite different from banks weighed down by rules, owning lots of assets, and struggling to innovate quickly.